Key Features

- Quick money on mutual funds as the loan is disbursed in 4 hours. If we delay, we’ll return 50% of your processing fee!

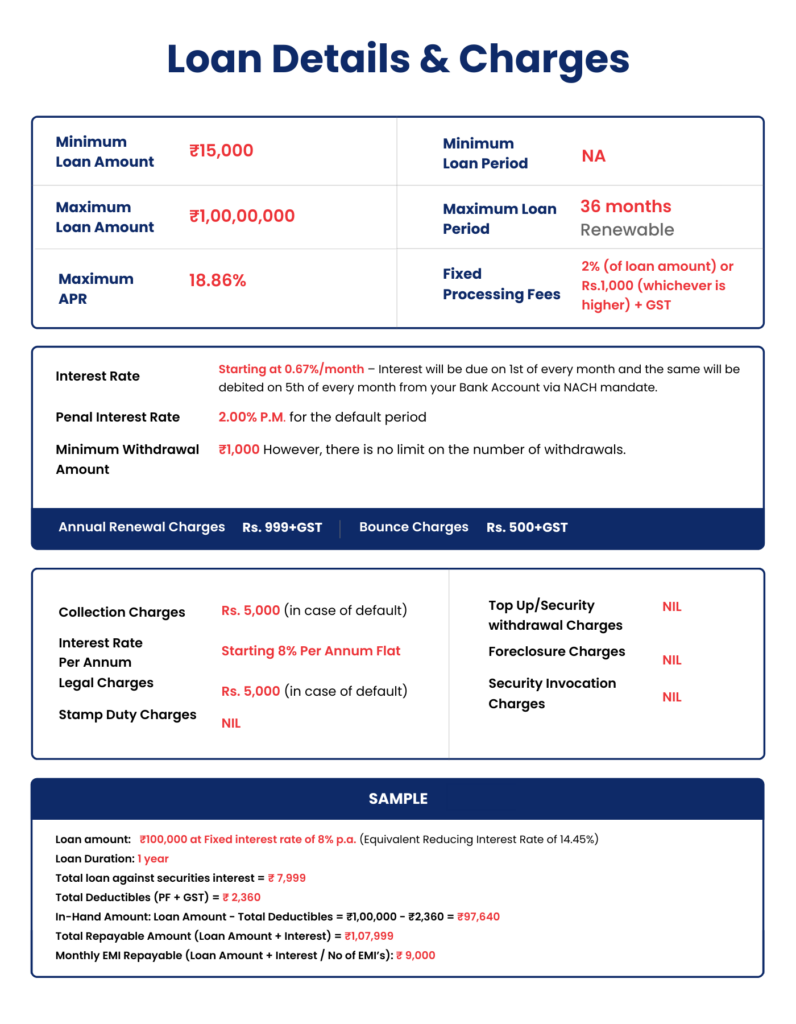

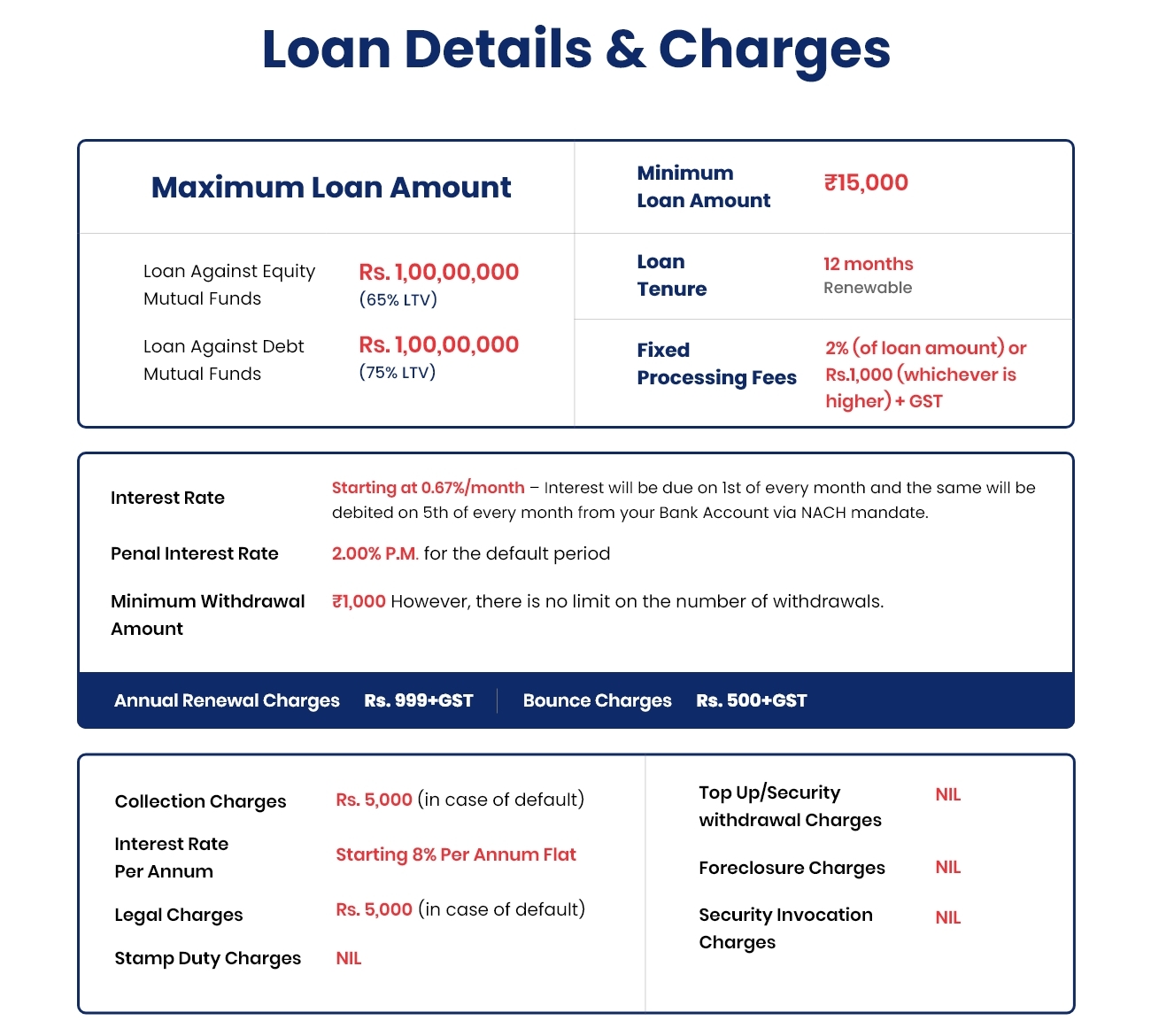

- Flexible loan ranges from Rs. 15,000 to Rs. 1,00,00,000 on your mutual funds

- Enjoy a loan size of up to 75% of your mutual fund unit value

- Very low EMI of only Rs. 1,333 for Rs. 1,00,000 loan amount, for example

- Pay interest only on the used amount

- Provider for an urgent loan with bad credit in India

Eligibility

- Single mutual fund unit holders can borrow a loan

- Mutual funds units in CAMS, KFintech & in DEMAT can get lending too

Documentation

- KYC documents or use Digilocker

You may use from the following documents :

PAN Card, Address Proof (Aadhaar / Driving License /

Passport / Voters Id)