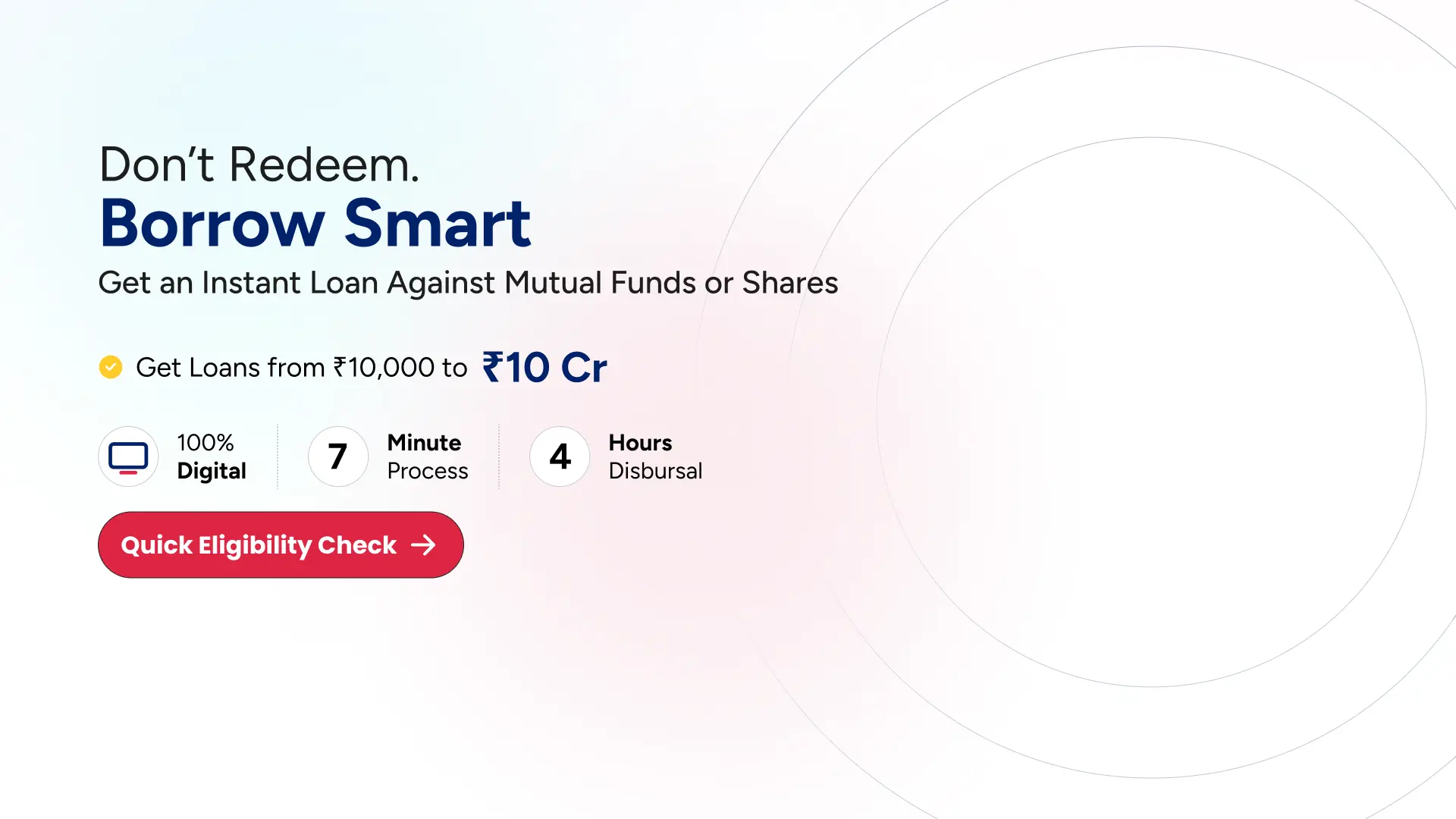

Loan Against Securities

Access Instant Liquidity by Unlocking Your Investments Potential

Need instant funds to meet your short-term financial goals? Instead of selling your investments, unlock liquidity against your portfolio with a Loan Against Securities at attractive interest rates. Stay invested and continue to benefit from long-term market growth while accessing funds when you need them.

Types of Securities

Loan Against

Mutual Funds

Use mutual funds as leverage for your loan against securities at low rates. Meanwhile, earn dividends while you access an instant loan without credit check.

Loan Against

Shares

Get a loan against your stocks. Unlock quick capital against securities, loan with your shares as security for your instant loan without credit score.

Loan Against

Bonds

A loan against Bonds is a simple and convenient way to receive instant funds for any financial requirements. You just have to pledge your Bonds as collateral and you’re good to go!

Features and Benefits of loan against Securities

Low EMI

We offer a low EMI on your loan against securities. EMI starting from ₹1,333 per month for ₹1,00,000 loan.

Instant Approval

Get instant approval on your loan against securities, disbursed within 4 hours with Terms and condition apply.

No Pre-payment Charges

You have the freedom to pay at will as we have no prepayment charges on your loan.

Cooling Off Period

During this cooling off period customer can decide not to continue the loan without paying any penalties or charges provided.

Affordable Interest Rates

Enjoy lower interest rates than personal loans and credit cards, making loans against securities a cost-effective borrowing option.

Don't Loose Sleep When Market Fluctuates

No penal charges when your shares/MFs/Bonds goes down.

Abhiloans is a product of KNAB Finance Advisors Private Limited, a non-deposit NBFC. We have brought the offer of loan against securities to a common man. We offer a loan starting from ₹10,000.

We take-away the anxiety, worry, and all the physical effort by our fully digital process. We ensuring loan disbursal within 4 hours.

Idea

Access an instant loan without a credit check by leveraging securities.

Promise

Get the funds in your account within just 4 hours—fast, easy, and hassle-free!

Growth

Payout early without any prepayment charges, and keep on earning from dividend & capital growth on asset.

Our Legacy in Numbers

How to Apply for a Loan Against Securities?

Get a loan on your securities with a paperless process

Step 01 ››

Check Eligibility of your portfolio

Step 02 ››

Select the type of loan

Step 03 ››

Pledge the type of securities

Step 04

Complete Digital KYC Verification process.

Step 05

Complete the E-mandate process and e-sign

A Powerful Community of Successful Freelancers

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Partner Program

Abhiloans offer an extra income source of more than 1 Lakh/month at no investment. Register now as a partner with AbhiLoans and start making money from anywhere.

Blogs & Updates

What Is an EMI Bounce Charge and Why Does It Matter

If you have ever taken a loan or used a credit card with monthly repayments, you are probably familiar with the term EMI. EMI stands

NOC Full Form: A Complete Guide to Loan NOC Meaning

If you have ever taken a loan, you may have heard the term “NOC” after completing your repayments. Many borrowers ignore this document, but it

Everything You Need to Know About Loan Against Securities (LAS)

In 2026, Indian investors no longer need to liquidate long-term investments to meet short-term liquidity needs. With equity markets continuing to reward patient investors and

FAQ

Most frequent questions and answers

A Loan Against Securities (LAS) is a flexible, secured credit facility that lets you unlock the value of your investments without liquidating them. By pledging securities like shares, mutual funds, and bonds as collateral, you can access quick liquidity whenever you need it.

The biggest advantage is that your portfolio continues to work for you meaning you still benefit from dividends and capital appreciation while the assets are pledged.

Typically, the approved loan amount is up to 50% of the market value of the pledged securities, making LAS an efficient way to meet urgent financial needs or seize new opportunities while keeping your long-term investments intact.

Yes, you can pledge all the securities in your portfolio whether mutual funds, equity shares, or bonds when applying for a loan against securities. This option allows you to access funds instantly while keeping your investments intact. Pledging your securities is an effective way to raise capital without selling your assets. It helps you maintain your portfolio’s growth potential while meeting your financial or business needs.

Even if you pledge your entire portfolio, the loan amount will depend on the market value of your securities. Typically, lenders offer between 50% and 60% of the portfolio’s value as a loan. At Abhiloans, you can get the best possible value for your shares up to ₹10 crore based on the eligible securities.

Yes, companies can avail a loan against securities held in their name, provided they meet the lender’s eligibility and documentation requirements. It’s an effective way to leverage investments such as mutual funds, shares, or bonds to manage short-term financing or business cash flow needs without liquidating assets.

When you take a loan against securities, ownership of the investments remains with you. The securities are only pledged as collateral, allowing you to continue earning dividends and returns while using the loan amount for business or personal purposes. You also pay interest only on the utilized amount, making it a flexible and cost-efficient funding solution.

Yes, you can make part payments on your loan against securities without incurring any prepayment charges but this facility is available only under the Overdraft (OD) product. The OD product from Abhiloans comes with a flexible part-prepayment option, allowing you to repay any amount at any time during the loan tenure.

This flexibility makes it easier to manage your cash flow and reduce your interest burden. With Abhiloans, borrowing against securities becomes even more convenient, helping you unlock the value of your investments to meet short-term financial needs without selling them.

You can pre-close your loan against securities at any time by repaying the outstanding principal along with the applicable interest. While pre-closure can help reduce your overall interest cost, some lenders may charge prepayment or foreclosure fees based on their policies.

It is always advisable to check the prepayment terms before applying. With Abhiloans, there are no pre-closure or prepayment charges, allowing you to repay your loan at any time without any additional cost.

A loan against securities is a secured credit facility that allows you to borrow funds by pledging your market-linked investments as collateral, without selling them. It is designed to help you meet short-term or medium-term financial needs while allowing your investments to remain intact and continue to benefit from market growth. Since the process is fully digital and requires minimal documentation, it offers quick access to funds at comparatively lower interest rates than unsecured loans.

The funds availed through a loan against securities can be used for a wide range of personal or business purposes, such as managing cash flow, consolidating existing debt, funding business expenses, supporting education needs, handling medical emergencies, or meeting other urgent financial obligations. There are no restrictions on end use, giving borrowers complete flexibility to use the funds as required.

A loan against securities is a secured credit facility that allows investors to unlock funds by pledging their investments as collateral, without selling them. Since the loan is backed by market-linked assets, it typically comes with lower interest rates compared to unsecured borrowing options and offers quicker approvals through a fully digital process.

This facility requires minimal documentation and does not involve lengthy verification procedures, making it suitable for borrowers who need quick access to funds. Repayment is also flexible, allowing borrowers to repay the loan as per their cash flow and reduce interest costs by closing the loan early. With Abhiloans, there are no prepayment or foreclosure charges, which gives borrowers complete control over their repayment schedule.

Overall, a loan against securities combines speed, flexibility, and cost efficiency, making it a practical solution for meeting short-term liquidity needs while keeping long-term investments intact.

Loans against securities can be availed by pledging different categories of eligible investments as collateral. Depending on the investments you hold, you can opt for a loan backed by mutual fund units, equity shares, bonds, or eligible insurance policies.

Each option allows you to unlock funds without selling your investments, while the approved loan amount is calculated based on the value and eligibility of the pledged securities.

To avail any of these options, the respective investments need to be pledged through a secure digital process, after which funds can be accessed quickly while you continue to remain invested.

A loan against securities is a secured facility where you can borrow funds by pledging eligible investments as collateral. The loan amount you can avail depends on the value and type of securities pledged, as well as the applicable loan-to-value (LTV) limits.

The minimum and maximum loan limits may vary across lenders. Generally, the maximum loan amount is calculated as a percentage of the market value or NAV of the pledged securities, with Abhiloans, you can avail a minimum loan amount starting from ₹10,000, and the maximum loan amount can go up to ₹10 crore, subject to eligibility and collateral value.

Pledged securities are valued based on real-time market prices or the latest available closing NAV, depending on the type of security. Since prices can change daily, the value of the collateral may fluctuate and affect the loan-to-value (LTV) ratio.

A margin shortfall occurs when the collateral value falls below the required level for the approved loan amount. In such cases, the borrower may need to add more collateral or repay part of the outstanding loan to restore the margin.

Understanding these valuation changes helps borrowers manage their loan better and avoid penalties or forced liquidation. Customers are informed about margin requirements and risks at the time of loan initiation to ensure timely action if market conditions change.

get the loan within 4 hours*

Get Money When You Need it

with Abhiloans

Our loan against securities include a minimum repayment period of zero months, as you can pay when you want with NIL prepayment charges, and a maximum repayment period of 1 year, which is renewable.