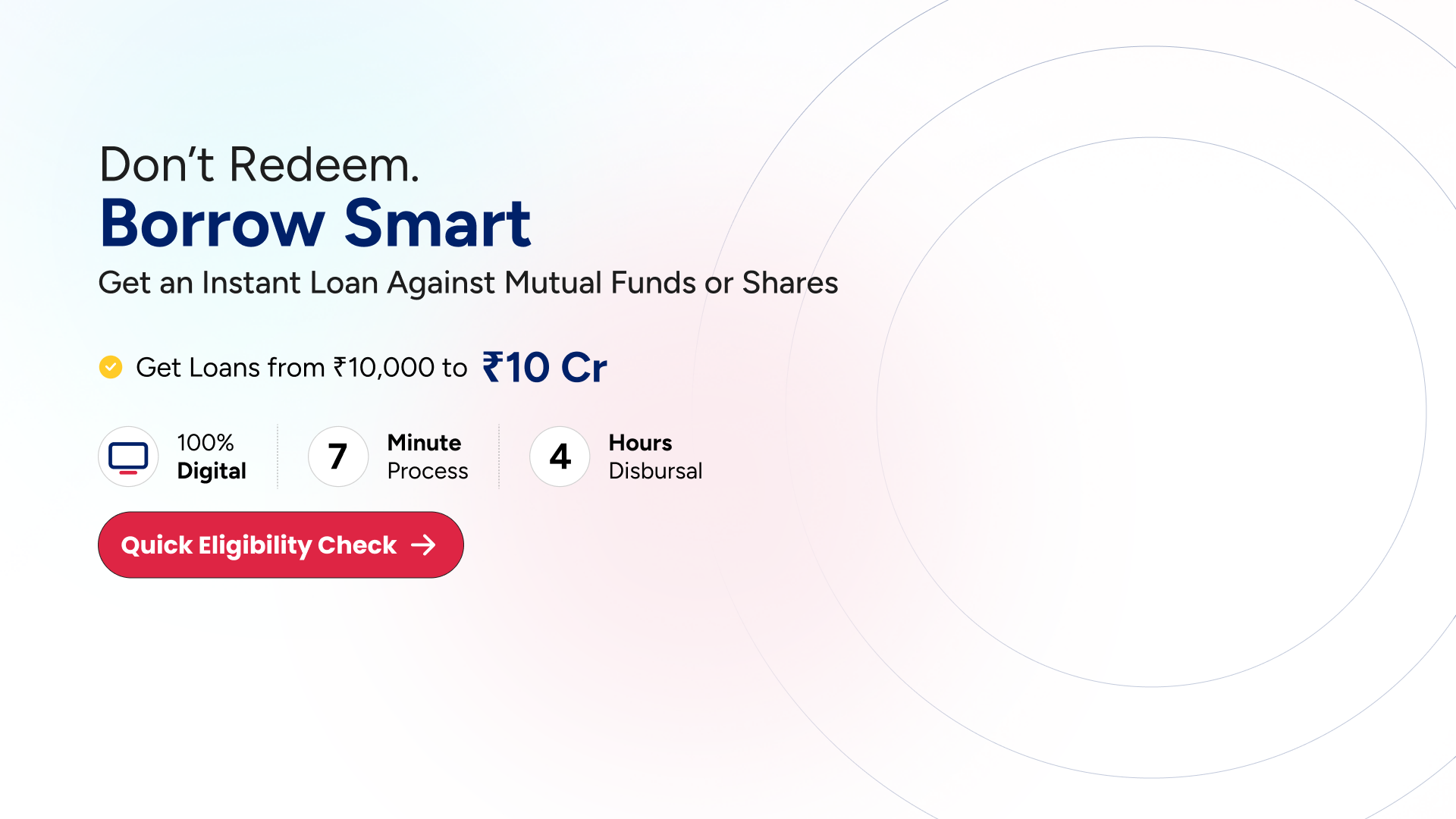

Loan Against Securities

Facing an urgent need for cash? Leverage your investments to get quick funds via Abhiloans loan against securities. Get up to 50% of the value of your securities against a wide range of collaterals, including shares, mutual funds, and bonds at attractive interest rates with loan disbursed within 4 hours.

Enjoy overdraft facilities against your shares, mutual funds and bonds. Don’t let your investments sit idle when you can achieve financial flexibility without selling them apply for Loan Against Securities with Abhiloans today and unlock your wealth.

Types of Securities

Loan Against

Mutual Funds

Use mutual funds as leverage for your loan against securities at low rates. Meanwhile, earn dividends while you access an instant loan without credit check.

Loan Against

Shares

Get a loan against your stocks. Unlock quick capital against securities, loan with your shares as security for your instant loan without credit score.

Loan Against

Bonds

A loan against Bonds is a simple and convenient way to receive instant funds for any financial requirements. You just have to pledge your Bonds as collateral and you’re good to go!

Low EMI

We offer a low EMI on your loan against securities. EMI starting from ₹1,333 per month for ₹1,00,000 loan.

Instant Approval

Get instant approval on your loan against securities, disbursed within 4 hours with Terms and condition apply.

No Pre-payment Charges

You have the freedom to pay at will as we have no prepayment charges on your loan.

Cooling Off Period

During this cooling off period customer can decide not to continue the loan without paying any penalties or charges provided.

Retain Fund Growth

Pledging your investments ensures that your savings grow, and your wealth plan remains intact even while you borrow.

Don't Loose Sleep When Market Fluctuates

No penal charges when your shares/MFs/Bonds goes down.

What Is Loan Against Securities?

Loan Against Securities is a type of secured loan which can be availed by an individual or a business to get funds by pledging their securities like stocks, mutual funds or bonds as collateral. LAS allows the borrower to use their current investment for money without liquidating it. The approved loan amount is 50% of the market value of the pledged securities.

Abhiloans is a product of KNAB Finance Advisors Private Limited, a non-deposit NBFC. We have brought the offer of loan against securities to a common man. We offer a loan starting from ₹10,000.

We take-away the anxiety, worry, and all the physical effort by our fully digital process. We ensuring loan disbursal within 4 hours.

Idea

Access an instant loan without a credit check by leveraging securities.

Promise

Get the funds in your account within just 4 hours—fast, easy, and hassle-free!

Growth

Payout early without any prepayment charges, and keep on earning from dividend & capital growth on asset.

Our Legacy in Numbers

How to Apply for a Loan Against Securities?

Get a loan on your securities with a paperless process

Step 01 ››

Check Eligibility of your portfolio

Step 02 ››

Select the type of loan

Step 03 ››

Pledge the type of securities

Step 04

Complete Digital KYC Verification process.

Step 05

Complete the E-mandate process and e-sign

A Powerful Community of Successful Freelancers

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Testimonials

Customer Reviews

Trustindex verifies that the original source of the review is Google. Easy processingTrustindex verifies that the original source of the review is Google. GoodTrustindex verifies that the original source of the review is Google. excellent

Customer Reviews

Trustindex verifies that the original source of the review is Google. Easy processingTrustindex verifies that the original source of the review is Google. GoodTrustindex verifies that the original source of the review is Google. excellent

Partner Program

Abhiloans offer an extra income source of more than 1 Lakh/month at no investment. Register now as a partner with AbhiLoans and start making money from anywhere.

Blogs & Updates

What is LTV (Loan-to-Value) Ratio and How is it Calculated?

If you’re applying for a loan like a home loan, or a loan against mutual funds or shares, you’ll often hear about the Loan-to-Value (LTV)

What is loan against property and how Does It Work?

A Loan Against Property (LAP) is a type of secured loan where you pledge your residential, commercial, or industrial property as collateral to avail funds.

Get a ₹50000 Loan Without CIBIL Score: A Complete Guide

Financial emergencies can come unannounced: a sudden medical bill, urgent home repair, or unexpected travel expense. In such situations, many people turn to personal loans.

FAQ

Most frequent questions and answers

Applying for a loan against securities is easy and convenient. It is a way to access quick capital against shares, mutual funds and bonds. With banks/NBFCs facilitating their customers with the end-to-end, digital process, getting a loan against mutual fund schemes and other financial securities has become easier and faster.

At Abhiloans, applying for a loan against securities is as simple as following a four-step process.

Get instant approval for loan against securities by logging into abhiloans.com via your Aadhar-linked mobile number, uploading digital copies of your KYC documents, and marking the lien on the MF or shares you want to use as collateral. The next and last step takes nothing but waiting for approval and getting the loan amount disbursed into your account. With us, it takes a few minutes to apply for a quick loan against securities.

Absolutely! Whether they are borrowing against mutual funds, equity shares or bonds, an instant loan against securities allows customers to pledge all their securities in their portfolio as collateral. It is common practice for investors to secure funds for business or investment opportunities.

Pledging securities is a great way to gain access to funds without selling off the underlying assets. It also allows customers to keep their portfolios intact while meeting their borrowing needs.

Even if they pledge all their securities to secure a quick loan online, they will get the amount based on the value of the assets in their portfolio. The loan against shares maximum limit would be 50-60% of the value of the investments, varying from lender to lender. Abhiloans provides the best value for the shares, which can go up to ₹10 Crore.

Taking an instant loan against securities is an excellent way for customers to leverage their investments for short-term financing needs. Customers holding securities in their company’s name can get a quick loan online using them as collateral provided they fulfill all eligibility requirements and the security meets the lender’s acceptance criteria. It is an efficient way to manage cash flow needs without compromising on ownership of assets.

When customers consider borrowing against mutual funds, shares or bonds, they do not lose ownership of their investments and continue to earn dividends and returns on them. They can use the loan amount for various purposes by paying the interest only on the utilized amount.

Yes! Customers can avail of an instant loan against securities held by their spouse, children, or parents. But while pledging those securities to apply for a quick loan online, they are required to include all those security holders as co-borrower/security providers.

That means borrowing against mutual funds, shares, and bonds is possible only when the legal holder gives his/her written consent for the same.

Customers must ensure that all legal requirements are met and provide supporting documents from both parties to prove ownership. They must also have the written authorization of a spouse or parent to pledge such securities on their behalf.

If you are looking for ways to make part-time payments on your instant loan against securities, you can make such payments without incurring any prepayment charges but only for OD product.

The OD product from Abhiloans come with a part-prepayment facility. With this, the customer can part prepay as much as they want during the tenure of the loan.

This facility makes borrowing against securities from Abhiloans a go-to choice for investors looking to fund their short-term financial needs. So, if you want to leverage your investments to get a quick loan online, choose a financial institution that offers such a facility.

You may choose to pre-close your loan anytime you want after payment of interest and the principal loan amount. Pre-closing your instant loan against securities can be beneficial, but it might attract certain charges, varying from lender to lender.

So, it would be wise to ask the lending institution if they charge any prepayment fee before applying for a quick loan online against your stock market investments.

However, not all lenders charge prepayment fees when you pre-close your loan against securities. Abhiloan is one of the NBFC companies that facilitate you to pay at will on quick loans online or instant loans against securities without incurring additional prepayment charges.

A loan against securities or a digital loan against securities is a type of loan that allows individuals to borrow money by using their investments as collateral. This loan is effective for people looking for quick access to funds without liquidating their investments. It is also a great way to diversify your portfolio and manage your financial risks. With this kind of loan, you can have the funds available when you need them.

The convenience of digital applications makes it possible to process and disburse the loan into your account. While some lenders might take days to approve the loan, Abhiloans promises to offer it in a matter of hours (within 4 hours)*. So, you may apply for a loan against securities online for fast access to funds.

A loan against Securities is a financial service that allows you to borrow money against the security of your stock market investments, such as equity shares, bonds, mutual funds, etc. It is a convenient and secure way to access funds in times of financial need. It is a quick online, which helps you access easy short-term financing with minimal paperwork and low-interest rates.

The money obtained from instant loan against securities can be used towards serving any of the following purposes:

- Pay off your existing debt

- Invest in some profitable ventures (a new or existing business)

- Renovate your home

- Fund your child’s education

- Meet medical emergencies

- Pay other bills

- Pay down your mortgage or other debts on the property that is being used as collateral

A loan against securities, which is synonymous with an instant loan against securities or a digital loan against securities, is an attractive option for investors looking to monetize their investments.

It is a type of secured loan that offers borrowers several features, making it a feasible borrowing option.

Some of the known features of an instant loan against securities are as follows:

- Competitive interest rates: since it is a secured loan, the interest rate is comparatively low.

- No hefty documentation is needed: it requires minimal paperwork and no credit history check, though with selected lenders, such as Abhiloans, which makes it a viable borrowing option for those looking for a loan for low credit scores.

- Flexible repayment options: it facilitates flexible repayment options. With Abhiloans, borrowers can pay at will without paying prepayment charges.

- Easy and fast processing: last but not least, a digital loan against securities feature easy and quick processing.

If you have in mind a loan against securities online, understanding their different types will help you make a prudent decision. You may take these loans against multiple approved securities such as stocks, bonds, mutual funds, and other financial instruments.

They offer an attractive interest rate and allow you to use the loan proceeds for any purpose. With a loan against securities online or a digital loan against shares, you can access funds quickly and easily without having to liquidate your investments or risk losing out on potential returns.

The various types of loan against securities include:

- loan against mutual funds

- loan against shares

- loan against bonds

- loan against insurance policies

For each loan, you need to pledge the securities associated with its type. For example, if you take a loan against mutual funds, you will have to pledge your MF units as collateral to secure the loan.

An instant loan against securities can help you meet your short-term financial needs. It is a secured loan where you can borrow funds against the security of your non-encumbered investments, such as stocks, mutual funds, and bonds. It’s a quick loan online that gives you flexible loan amounts to fit your varied fund requirements.

The minimum loan amount provided by lenders varies from one financial institution to another. On the other hand, the maximum loan amount will depend on the market value of your security. It is worth noting that borrowing against mutual funds will get you a higher loan value than against shares.

If you choose Abhiloan as your lender, you can get a minimum loan value of INR 10,000. The maximum amount you can get here is ₹10 Crore.

The pledged securities are valued on a real-time basis or the closing NAV, given the type of security. The valuation of these securities may change on a daily basis depending on the movement in their prices. The valuation change as the price of pledged securities fluctuates.

When taking an instant loan against securities or a quick loan online leveraging your investments, it is crucial to understand margin shortfall and its associated penalties.

Margin shortfall can be an expensive and difficult problem to solve, especially when it comes to valuing pledged securities. To determine the margin shortfall, a proper understanding of the current market conditions of the pledged securities must be taken into account.

Investors considering borrowing against mutual funds, shares or bonds may approach Abhiloans to apprehend the risks associated with margin shortfall. It will help them prevent the chance of potential losses due to it.

get the loan within 4 hours*

Get Money When You Need it

with Abhiloans

Our loan against securities include a minimum repayment period of zero months, as you can pay when you want with NIL prepayment charges, and a maximum repayment period of 1 year, which is renewable.